crypto tax calculator australia

This means you can get your tax details up to date yourself allowing you to save significant time and reduce the bill charged by your accountant or tax agent. You simply import all your transaction history and export your report.

The Ultimate Australia Crypto Tax Guide 2022 Koinly

6 articles in this collection Written by Patrick McGimpsey and Shane Brunette.

. Crypto Tax Calculator for Australia NZ Crypto Tax Calculator for Australia Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance Capital gains report Miningstaking Income report Free tax preview Start for free See our 500 reviews on Did you receive a letter from the ATO. Sort out your crypto tax nightmare. You simply import all your transaction history and export your report.

8500 upfront for 50 reports and 185 per report thereafter. Crypto by reading his price list. Use our Crypto Tax Calculator.

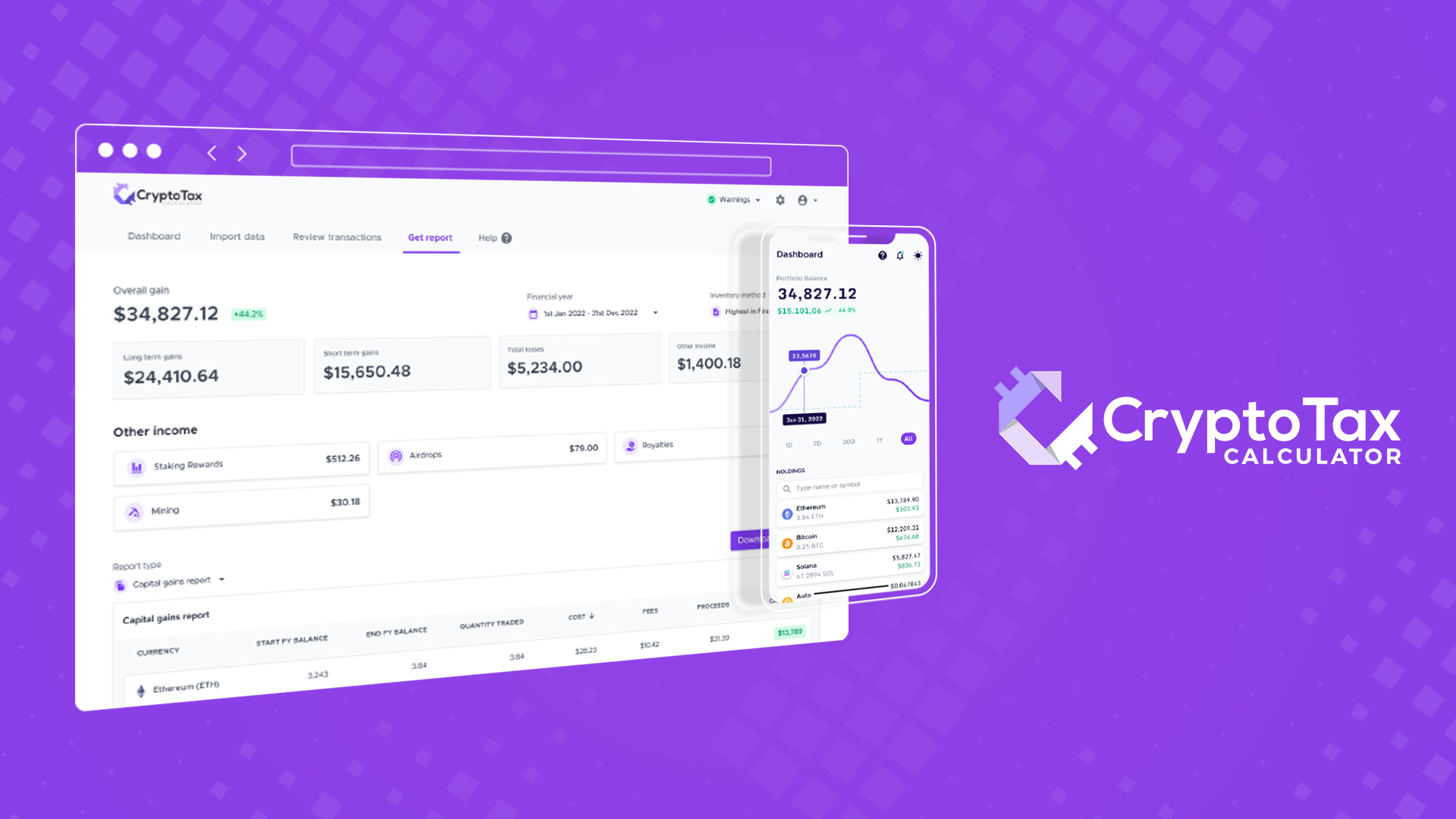

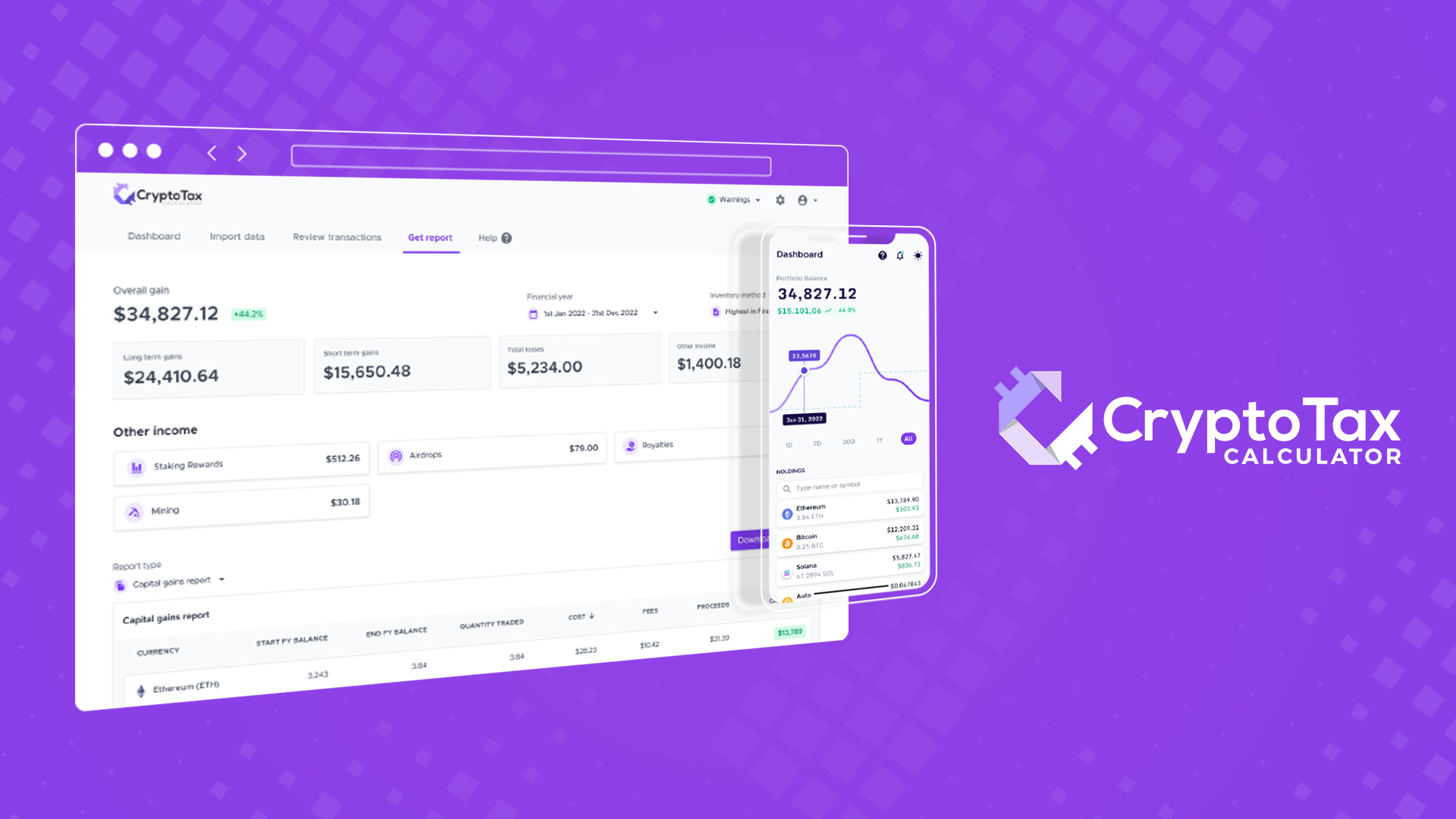

This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements. Basic 49 Year For the beginner or basic trader. Crypto tax calculator seems like a really robust bit of software.

For example if you purchased Ether at 100 and sold it at 150 your gain would be 50. Start from your myTax account available from your myGov dashboard. Crypto Tax Calculator Australia prides itself on making it simple and easy for you the customer to use our top of the range service and application when it comes to calculating your cryptocurrency tax.

The basis and price must then be subtracted from any fees your customers have paid to view the item. Thats just over 4 a month for your peace of mind when it comes to crypto tax in Australia. All have pros and cons - but for me with a lot of defi transactions I have to say cryptotaxcalculator has been the easiest especially for those in Fantom DEFI.

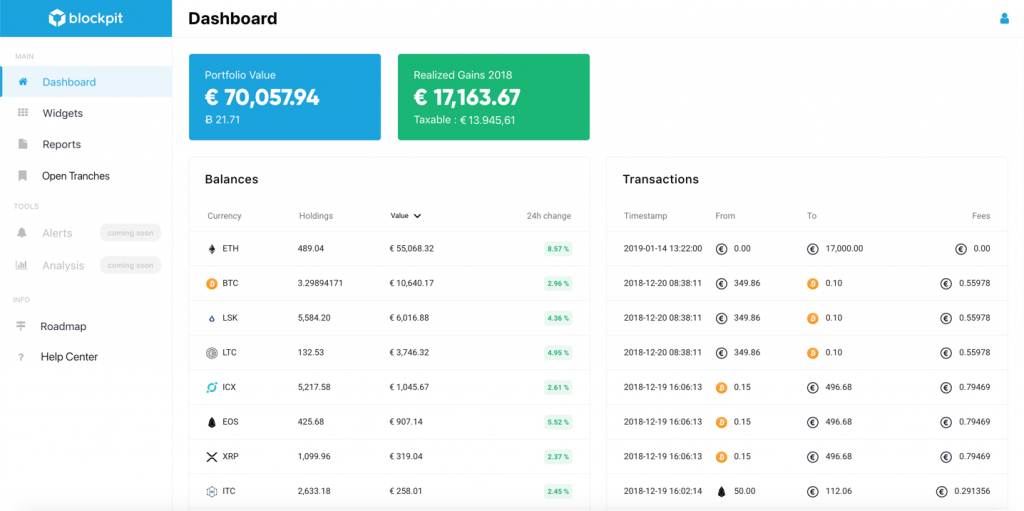

Integrates major exchanges wallets and chains. Get Started For Free. A pioneer in crypto tax software.

Guides and tips to assist with the generation and submission of reports. Covers NFTs DeFi DEX trading. Online Crypto Tax Calculator with support for over 400 integrations.

This means you can get your tax details up to date yourself allowing you to save significant time and reduce the bill charged by your accountant or tax agent. Overall best crypto tax software. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space recently told DMARGE crypto is. Plans Pricing Generate reports for all financial years under just the one 365-day subscription. Unlimited coins transactions exchanges access by any staff member.

Well Crypto Tax Calculator Australias plans and pricing are extremely affordable and versatile so you can choose the plan that works best for you based on your trading history. 49 for all financial years. Direct support for over 400 exchanges wallets DEXs and DeFi protocols.

Supports DeFi NFTs and decentralized exchanges. Thankfully the numbers seemed to align with my calculations on simpler CGT disposals. 200 per report payment upfront by credit card or direct debit.

If you then purchased Bitcoin for. Using The Australian Cryptocurrency Tax Calculator The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of. Once you or your accountant have calculated your crypto tax totals we have an app for that the easiest way to file your taxes in Australia is online using myTax available from your myGov dashboard.

Get an accountant to do it for you by supplying your transaction history statements and crypto to Australian dollars conversions. Best crypto tax software for complex filing. Crypto Tax Calculator Australia offers package deals with SMSF Accountants or accounting firms as a whole.

You can do this step using a crypto tax calculator. Yes you can CryptoTaxCalculatorAustralia is designed to generate easy tax reports. It works by inputting the above information and calculating the gain or loss.

CryptoTaxCalculator The most accurate crypto tax software solution for both investors and accountants. And when it came to my 200 Eth transactions it looks like it has reconciled them all. These guides cover various crypto-specific scenarios.

Our crypto tax calculator plans can cost less per year then a subscription to a streaming service. By multiply your sale price by the total amount of the coin you sold you can obtain value. How Do I Calculate Crypto Taxes.

Crypto Tax Calculator Help Center. Picks up all transactions across main exchanges metamask even OpenSea. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader.

Yes you can CryptoTaxCalculatorAustralia is designed to generate easy tax reports. Best tool to manage my crypto tax in Australia I have spent a while doing some comparisons on good crypto accounting tools - looking at koinly cointracker and cryptotaxcalculator CTC for trading. How Much Tax Do I Pay On Crypto In Australia.

Powerful Accurate Tax Reports. Our platform performs tax calculations with a high degree of accuracy. Their plans start at only 50 per year on a subscription basis.

At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously. Use a crypto tax calculator like the one available with Accointing to create crypto tax reports which can be added to your tax returns when filing them yourself online through myTax. You can import data for all the Cryptocurrencies you have traded with and our application will combine them all into one report.

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

Top 10 Crypto Tax Return Software For Australia Crypto News Au

Cryptocurrency Tax Software Crpytotrader Tax Now Available In Australia Bitcoin Com Au

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax In Australia The Definitive 2021 2022 Guide

Next Steps Australia Crypto Tax Report Cryptotrader Tax

Top 10 Crypto Tax Return Software For Australia Crypto News Au

![]()

Cointracking Crypto Tax Calculator

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

![]()

Top 10 Crypto Tax Return Software For Australia Crypto News Au

![]()

Cointracking Crypto Tax Calculator

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Koinly Crypto Tax Calculator For Australia Nz

Crypto Tax Calculator Review April 2022 Finder Com

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda