corporate tax increase proposal

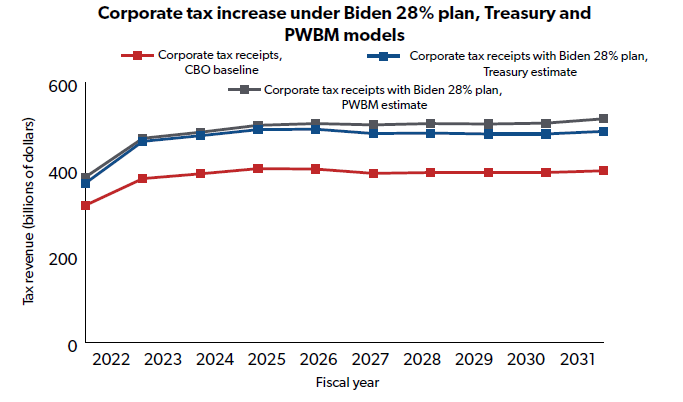

An increase in the federal corporate tax rate to 28 percent would raise the US. Democrats release details of corporate minimum tax proposal.

Federal Tax Bill Breakdown Leader S Edge Magazine

US Corporate Tax Rate Non-US.

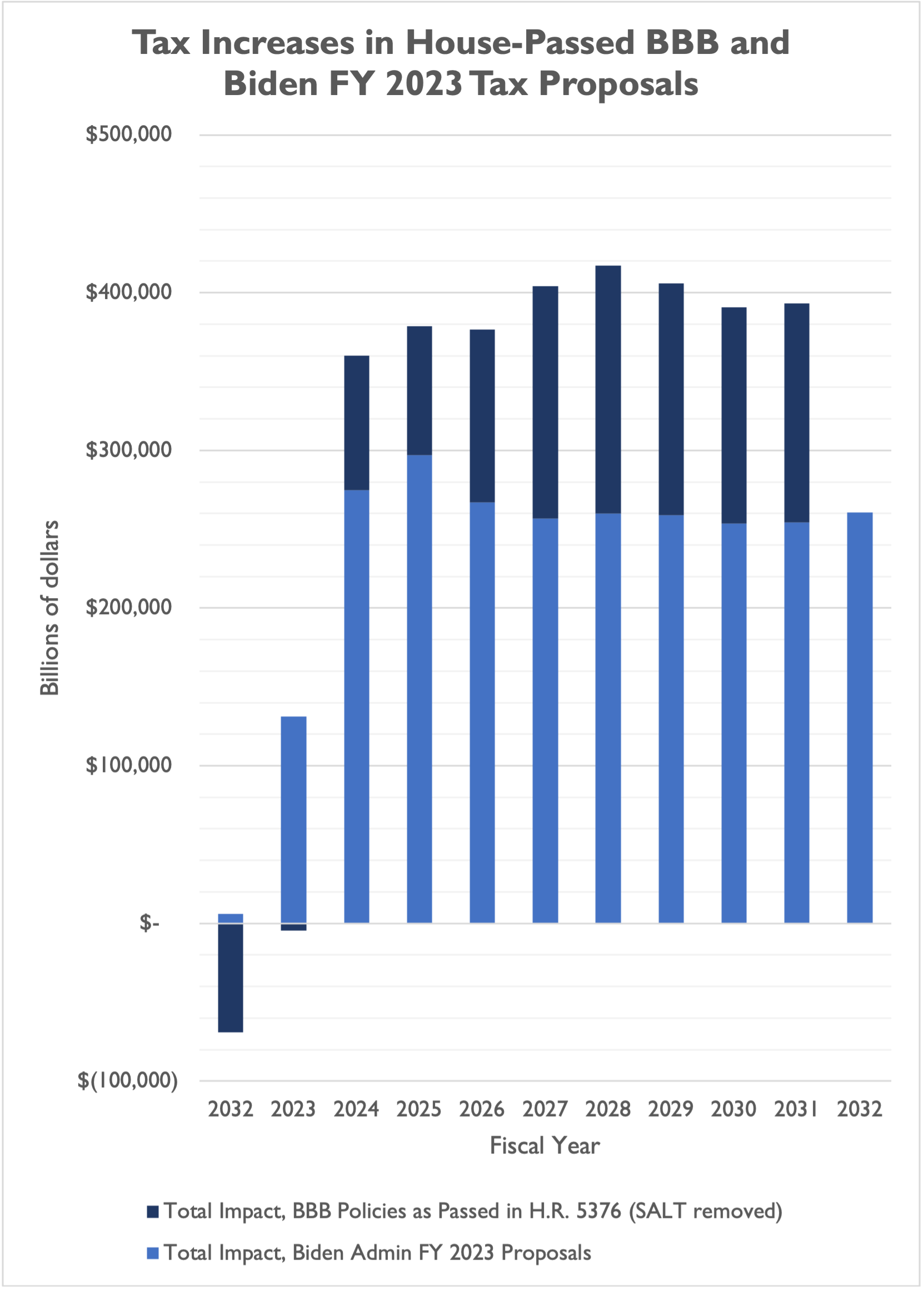

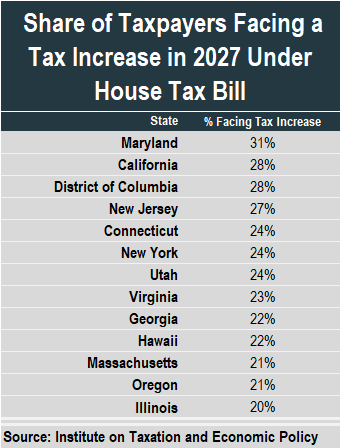

. Increasing top tax rates for individuals. In addition to a proposal to. The proposal would increase the capital gains tax rate for those with an income above 400000 to 25 from the current 20 and include an additional 3 surcharge on taxable income over.

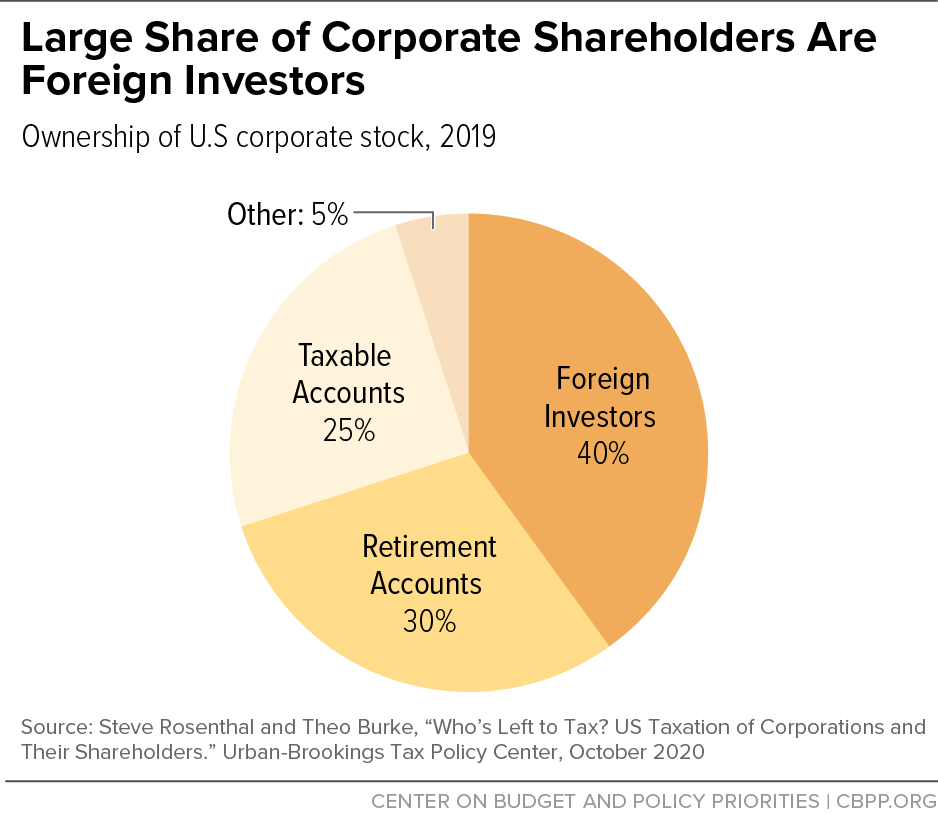

The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum. Corporate Income Tax rate is More Competitive. The tax provisions of the FY23 budget are intended to.

Pay more in taxes but the overall scope of the. The proposed corporate profit minimum tax would add significantly to the complexity of corporate tax compliance and administration. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations tax rate from 21 to 28.

OECD Weighted Corporate Tax Rate Non-US. The budget proposes several new tax increases on high-income individuals and businesses which combined with the BBBA would give the US. The White House summary indicates that the Made in America Tax Plan is expected to increase federal revenues by over 2 trillion over 15 years to more than pay for.

The highest combined corporate. The former vice presidents corporate tax increase is by far the largest hike of a bevy of taxes Biden has proposed on the campaign trail. Federal-state combined tax rate to 3234 percent giving the US.

OECD Unweighted Corporate Tax Rate The US. The top marginal tax rate will increase from 37. The 28 tax rate would be effective for.

The tax plan would raise the corporate rate to 28 percent from 21 percent to help fund the presidents economic agenda. The highest top tax rates on. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in.

Other Tax Increases Released in Bidens Budget Proposal. WASHINGTON New details of a Democratic plan to enact a 15 minimum corporate tax on declared income. As part of the landmark infrastructure plan Biden will on Wednesday propose a tax strategy that would increase the corporate tax rate to 28 from 21.

The tax rate for C corporations will increase from 21 to 28. In our new book Options for Reforming Americas Tax Code 20 we illustrate the economic distributional and revenue trade-offs of 70 tax changes including President Bidens. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to.

The most important proposal for companies is the possible increase in the corporate tax rate from 21 to 28. The American Enterprise Institute a. House Democrats outlined tax increases they aim to use to offset up to 35 trillion in spending on the social safety net and climate policy.

Revenue Effects1 Corporate Tax Rate.

Tag Archive Tax Increases American Enterprise Institute Aei

How Biden S 2 Trillion In Tax Increases Target Companies And The Rich The New York Times

Biden Tax Plan Change A Few Numbers Raise Taxes By Trillions

Biden S Total Agenda Adds Up To Nearly 3 5 Trillion In Tax Increases Publications National Taxpayers Union

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

Flawed Data From House Leadership Attempts To Hide Tax Hikes Under Proposal Itep

Mapped Biden S Capital Gain Tax Increase Proposal By State

Trump Tax Proposal Two Charts That Show Why It S Misguided

40 Plus Tax Increases A Rundown Of House Dems 2 Trillion Tax Plan Politico

Big Business In Minnesota Draws A Line At Biden S Proposed Tax Hike

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Factchecking Tax Claims In The 2020 Election Committee For A Responsible Federal Budget

Biden S Corporate Rate Increase Would Raise Revenue Efficiently And Progressively Tax Policy Center

What S The Deal With The Corporate Tax Publications National Taxpayers Union

The Stock Market S Leaders Appear Most Vulnerable To Biden S Tax Plan Wsj

What S In Biden S Tax Plan The New York Times

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Democrats Are Among The Doubters Of Biden S Plan To Tax The Rich Financial Times